How much can the domestic small-pitch LED market grow in 2024? Industry analysts believe this mainly depends on the speed of price decline.

Price decline drives rapid growth of market below P1.5

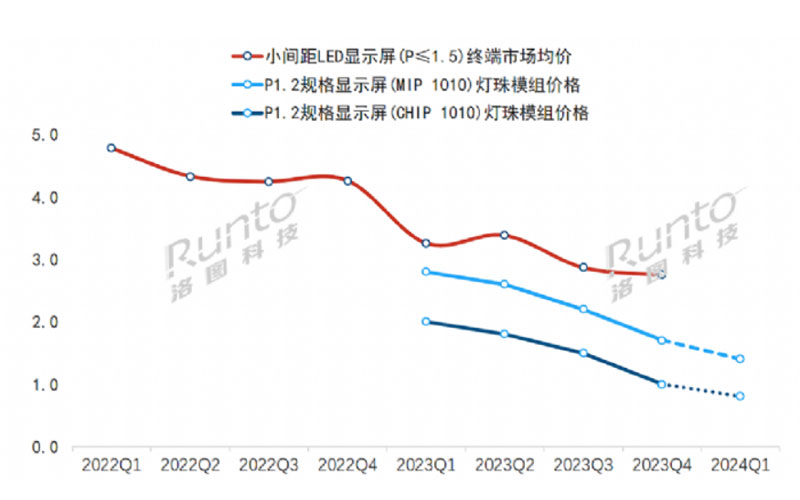

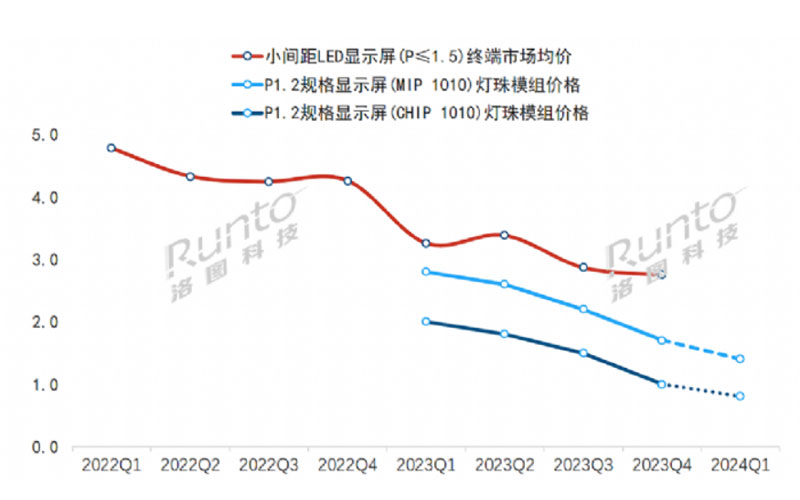

According to Luotu Technology data, in the domestic small-pitch market in 2023, the average price of products with P ≤ 1.5 dropped from 48,000/square meter in early 2022 to 27,000/square meter in the fourth quarter of 2023, a drop of 42%.

Supported by this rapid cost and price decline, in 2023, the sales scale of P≤1.5 product market in domestic small-pitch LED displays will increase from 55.7% in 2022 to 61% in 2023; the shipment area will account for The ratio will increase from about 13.2% in 2022 to about 18.4% in 2023, and the shipment area will increase by 47% year-on-year.

This set of data reveals two basic facts: first, the rapid price drop has promoted the increase in industry market size, that is, the year-on-year sales area growth of P≤1.5 products will be 47% in 2023; second, price still determines the final market choice And the demand scale, that is, the market sales area of small-pitch LED screens with P>1.5 still accounts for more than 80% - after all, the average price of P≤1.5 is 6-7 times higher than that of P>1.5.

Based on this, the industry believes that P≤1.5 products will continue to maintain a relatively high growth trend in 2024 under low prices and further downward price trends. Among them, Luotu Technology predicts that the market sales of P≤1.5 display screens in mainland my country will reach 11.2 billion yuan in 2024, a year-on-year increase of 19% in 2023. ——The growth rate of sales area will continue to be significantly higher than 20%, maintaining a medium-to-high growth trend.

In 2024, the price war below P≤1.5 is likely to further intensify

From 2022 to 2023, the main price reduction of domestic P≤1.5 LED products will be COB technology products. Luotu Technology data shows that the market penetration rates of COB products in the first three quarters of 2023 are 8.3%, 10.7%, and 14.4% respectively, and the trend of accelerated improvement is very obvious.

Especially in the third quarter, the shipment area of COB products increased nearly 2.5 times year-on-year, which was almost explosive growth. This is mainly due to the rapid cost and price reduction of COB panels in 2023. In the first three quarters, the average price of COB small-pitch LEDs dropped by more than 30%. It is reported that the price of COB in the P1.2, P1.5 and other point pitch segments is rapidly approaching that of traditional SMD, and the price in the P0.9 point pitch segment is already lower than that of SMD products.

Why will COB products set off a price war with almost half discounts throughout the year in 2023? There are two main reasons:

First, COB technology has become more mature after years of development. In terms of technology, the packaging yield and pass-through rate have increased rapidly; in terms of materials, LED chip miniaturization, PCB and driver IC component costs have dropped; in terms of industry, the scale of COB has further increased, and early R&D cost investment has been recovered... These factors have made this " COB products with fewer links in the industrial chain and fewer enterprises involved in end products have a certain cost advantage.

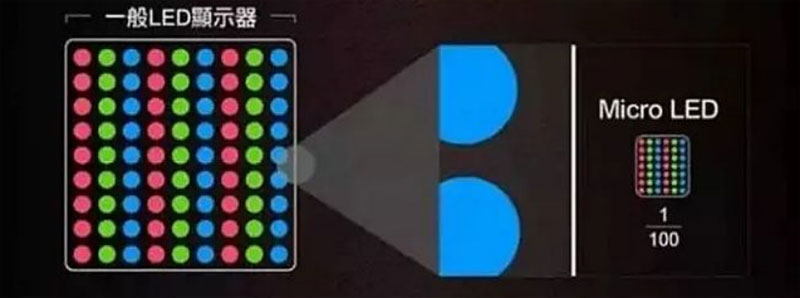

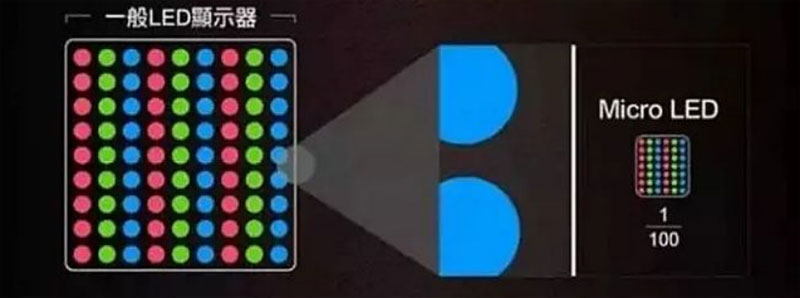

The second is that for COB technology, "the wolf is coming". 2023 is the first year that MIP packaging technology will enter the market on a large scale. Continuing from before 2023 to early 2024, the MIP terminal LED screen product models and brand participation scale launched by industry companies will increase nearly 10 times. As an upgrade technology for integrating traditional SMD products into the micro LED era and upgrading to smaller sizes, MIP has lower upstream process difficulties at this stage, fully inherits the equipment and processes of SMD technology in the downstream, and better balances the interests of LED packaging companies in the midstream. , forming the advantages of low investment, low difficulty and adaptability to the existing industrial chain. These advantages, in the words of the MIP camp, are "protection of the division of labor in the existing industrial chain and lower implementation costs." ——The former is conducive to rapid expansion, and the latter is conducive to low-cost competition.

That is, "in 2024, small-pitch LEDs, especially the P ≤ 1.5 market, will face a cost duel between COB and MIP." At present, after the price of COB 0.9 mm pitch products has been lower than that of SMD technology in 2023, the 0.9 pitch specifications of MIP technology have already It has become the "favorite" of LED direct display companies that do not master COB technology. On P0.9 products, the direct confrontation between COB and MIP is very significant.

The price war in the P≤1.5 market in 2024 will change from a one-man show of COB in 2023 to a two-player show of COB and MIP - this is already an arrow.

The end of technology is always "lower cost"

The development of Led displays has entered a new stage: that is, new technologies have shifted from the previous tendency to improve performance and increase costs to the main competition in the future to reduce costs. That is, the ten-year development process of COB technology has significantly shifted from continuously climbing technological peaks and launching extreme pitch products in 2022 and before, to focusing more on cost reduction of existing product lines after 2023.

From the perspective of technology path, the industrial chain of COB technology from LED wafer link to complete machine screen is shorter. That is, COB technology is both a package and a complete machine. A simpler process and material savings will theoretically give COB products a cost advantage in addition to better image quality and reliability at the same pixel density. Both performance and cost should have advantages, and it increases the depth of core technology participation of terminal enterprises. This is the reason why COB technology is widely popular.

However, for small and medium-sized, second- and third-tier terminal LED display manufacturers, COB has technical difficulties and investment costs. At this time, MIP comes on stage.

The main advantage of MIP is that the difficulty of large-scale transfer in the upstream is an order of magnitude lower than that of COB. The midstream and downstream fully take care of the division of labor structure of the existing industry chain, and is compatible with current SMD process equipment in the downstream. This allows more second- and third-tier brands to enter the higher-standard LED screen market without relying on COB technology. That is to say, the advantages of MIP are concentrated in two aspects: lower technical difficulty and more participating and supporting manufacturers. Both of these are beneficial to product cost reduction.